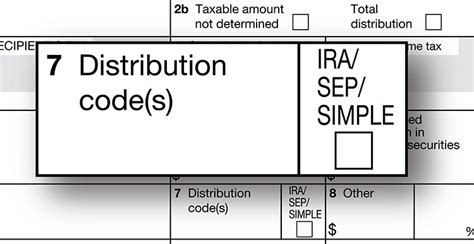

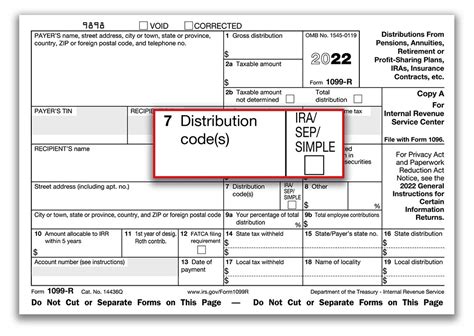

1099 r box 7 distribution code 1 Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

There are two ways that you can fit up your metal: with a gap or without one. There are pros and cons to both ways, but if your metal is thinner than 3mm, you won’t need a gap. When fitting your sheet metal together, you .

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

In this article, we’re going to explain the best ways to weld sheet meta l with flux core so that even novice welders and DIYers can succeed on their first try. Always conscientiously choose the diameter of flux-cored wire you’re going to .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 . Use Code 1, Early distribution, no known exception, for Traditional and SIMPLE IRAs and QRPs only if the individual is not age 59½ or older and codes 2, 3, and 4 do not apply.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the .

irs distribution code 7 meaning

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andIf an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .

irs 1099 box 7 codes

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Use Code 1 if the individual modified a series of substantially equal periodic payments before the end of the five-year period that began with the first payment, even if he or she is age 59½ or older. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment Advisor Support . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% .

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. screen to use the separate treatment. You won’t be able to enter both codes in the. field. Per Form 1099-R Instructions, you can enter a numeric and an alpha code. For example:Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

brick electrical box cover

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Use Code 1 if the individual modified a series of substantially equal periodic payments before the end of the five-year period that began with the first payment, even if he or she is age 59½ or older. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment Advisor Support . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% . Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .

bridgeport milling machine cnc conversion

form 1099 box 7 codes

Still, it’s possible to weld thin sheet metal using the MIG (GMAW), TIG (GTAW), and stick (SMAW) processes. But MIG and TIG provide the best results. This article will teach you how to weld thin gauge metal using each arc welding process and present the common pitfalls beginners make.

1099 r box 7 distribution code 1|1099 r distribution codes 7d