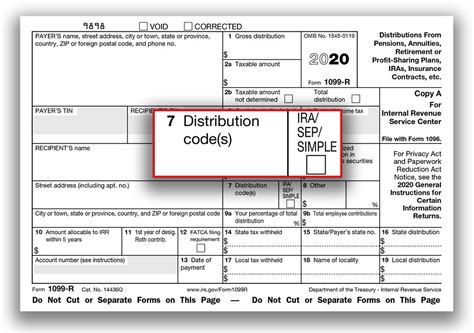

income tax w2 distribution box 7 not checked Box 7 - IRA/SEP/SIMPLE check box will be checked if the distribution is from and IRA, SEP, or SIMPLE plan. Box 8 - Other shows the value of any annuity contract that was part of the distribution. This amount is not .

Junction boxes are required by law. Junction boxes can be put in when a building is built or get added with electrical changes, upgrades, and improvements. How Many Junction Boxes Should I Have? The number of junction boxes .

0 · irs 1099 r box 7

1 · form 1099 r box 7 disability

2 · form 1099 r box 2b

3 · box 7 distribution code

4 · 1099 r box 7 examples

5 · 1099 r box 7 distribution

If circuit conductors are spliced within a box, or terminated on equipment within or supported by a box, all wire-type equipment grounding conductor(s) associated with any of those circuit conductors shall be connected within the box or to the box in accordance with 250.8 and 250.148(A) through (D).

What makes you think that the total distribution box or the IRA/SEP/SIMPLE box is causing the problem? For income from a pension, those two boxes would normally not be checked. February 20, 2023 7:32 PMWhat makes you think that the total distribution box or the IRA/SEP/SIMPLE .What are the tax deadline extensions for those affected by natural disasters? .We're excited to announce our newest series of TurboTax Community Tax .

We would like to show you a description here but the site won’t allow us. Box 7 - IRA/SEP/SIMPLE check box will be checked if the distribution is from and IRA, SEP, or SIMPLE plan. Box 8 - Other shows the value of any annuity contract that was part of the distribution. This amount is not . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . A correct Form 1099-R will have ,585.87 in box 1, 5.87 in box 2a box 2b Taxable amount not determined not marked and codes J an 8 in box 7. I refer you to the .

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over . Code 7: Normal Distribution. Meaning: The distribution was made after the taxpayer reached age 59½. Tax Impact: Subject to regular income tax with no penalty. Code G: Direct Rollover. Meaning: Direct rollover from one . Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked .

Be sure you understand the code used in Box 7 on your Form 1099-R, so you can provide the correct information with your tax return to either pay the additional tax owed or prove you meet an exception to the tax.Employers submit Form W-4 to the Internal Revenue Service to report information such as marital status, number of dependents, and tax exemptions; while Form W-2 are distributed at the end of every tax year to report an employees’ . Yes, lauren-s you should see the full amount being included on Form 1040 line 4d and in taxable income. Make sure that when asked in the questions that followed entering the details of the Form 1099-R that you indicated the type of Roth account (either Roth IRA or Designated Roth Account in a 401(k), 403(b), etc.) to which you rolled over the distribution.

Double check Box 7 and the IRA box on your 1099-R. How will this impact my return? The distribution codes and IRA box describe the type of distribution. The program relies on these codes to make correct calculations. The distribution codes are found in box 7 of Form 1099-R. The IRA/SEP/SIMPLE box is usually located right next to box 7. However, the effect of Code 3 (Disabled) is to avoid the early distribution penalty, not tax altogether. The early distribution penalty happens if you withdraw money from a retirement plan prior to the age of 59 1/2 (55 in certain cases). Since you are 63, this does not affect you, so changing the code to "3" would not change your return and . Box 2B, total distribution, Box 7, IRA/SIMPLE/SEP are not checked on my 1099R so I didn't check them on TurboTax. System won't let me move forward. Simple tax situations (W-2 only) . If you have not withdrawn money from your retirement fund or have not received other retirement income, you should not receive a 1099-R form. The IRA/SEP/SIMPLE box is checked if the money is distributed from an IRA account. . The IRA/SEP/SIMPLE box is not checked for my distribution code 7 for my monthly .

irs 1099 r box 7

Distributions from a nonqualified 457(b) plan are required to reported by the payer in box 1 and in box 11 of Form W-2. These are included in your AGI for calculating Medicare premiums. The amount shown in box 11 is the amount of box 1 that is not subject to Social Security and Medicare taxes because these taxes were already been paid on this portion . Simple tax situations (W-2 only) . A Form 1099-R without a code in box 7 is not valid. If you are over age 59½, are you sure that box 7 does not have code 7? . If it was a regular distribution, go ahead and put code 7 in box 7. As dmertz points out, a 1099-R without a code in box 7 is not valid. I would speak to someone higher up at .If it's a 401k (vs 457) and you were an "active participant" then yeah, box 13 should be checked. W-2 instructions: Retirement plan. Check this box if the employee was an “active participant” (for any part of the year) in any of the following. . and the first section just adds up your income. So box 1 is the only thing that matters here . On the 1099-R, boxes 1, 2a, and 16 showed the amount converted; box 7 was coded G and IRA/SEP/Simple box was not checked. All the other boxes were either blank or not checked. I understand the converted amount was counted as taxable income. But when I entered G in box 7, Turbo Tax showed no tax on the amount converted.

W2 income box 1 includes income from all 100 shares vesting at FMV on vest date, as expected; 1099B shows two transactions: 40 shares sold to cover, 50 shares elected sale (basis is not reported, but I know to correct this from statements) W2 income box 2 does not include proceeds from 40 shares sold. It only shows my paycheck withholding amount

I have input the income on Box 8 as Ordinary income from 1099-R Box 2a, State taxes on line 11a, and Federal taxes on Schedule G Part II line14 with the box checked off. The state taxes are deducted from income correctly, but I am missing something as it indicates a refund of Federal taxes to the Trust and doesn't pass this on to the beneficiary.

"For tax years beginning on or after January 1, 2005, any amounts reported in gross income for Federal Income Tax purposes for a retirement annuity that is not an employer sponsored retirement annuity (reported as Codes 1D, 2D, 3D, 4D or 7D in Box 7 beginning with 2013 Forms 1099-R) are reported as interest income on PA Schedule A regardless of .Just like a W-2, 1099-R forms are released annually at the end of each year that you collect retirement income. . Box 2b: Taxable Amount Not Determined. Is Box 2b checked on your IRS 1099R? If so, then this means that there was not enough information provided to calculate your taxable amount. . Alternatively, you can choose to include the .

1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution." Box 6 being checked does not trigger the IRS computers. Simple tax situations (W-2 only) . it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not required to report this form to the IRS. In the past, required Minimum .

The marking of box 13 Retirement plan on your W-2 is quite possibly correct. It's possible that the employer made additions to your account in 2018 (say, from forfeitures from employees who separated from service before being fully vested in company matching contributions) or it's possible that additions were made to your account in 2017 but for the plan .

Imagine my surprise when I open my w2 today and see the federal income tax box empty! I go back to my pay stubs and notice that I must have been filed as exempt somehow with my new company. It's only a part time job, and I made around 10k for the year.

Simple tax situations (W-2 only) . You may have to pay income tax on the distribution, based on the type of plan and the manner in which contributions were made by the decedent. . For pensions and annuities, if the "Taxable amount not determined" box in box 2b is checked, the gross amount of the distribution in box 1 will be used as the . 1099-R Box 2=Taxable Amount Not Determined. Box 7 Dist code=T. 2021 return. This is for a Roth IRA, first withdrawal of K from the fund. During TT input, TT pops my original investment of K, which leads me to think that K would be taxed. Instead, the TT Fed Tax summary showed no increase..Double-check what happened to the amount on your W-2. It should be excluded from Boxes 3 and 5, but ideally included in Box 1.. If it is not included in Box 1, report the amount on Schedule 1, line 8j.. Correct, either way, you adjust the gain on Form 8949 by that amount.

1099R Box 7 says Code J but Roth IRA distribution shouldn't be taxed as it was CONTRIBUTIONS ONLY, not EARNINGS. Should I change Code to Q (qualified) & give explanation? You must go back to the 1099-R entry and edit the entries to .Step 1. Keep a daily log of the tips you receive. The IRS also considers non-cash gratuities, such as event tickets, as tips. Record the value of those in the same tip log.

Simple tax situations (W-2 only) . You get the cash or check each month. You did not roll it over. June 6, 2019 6:46 AM. 1 5,406 Reply. Bookmark Icon. Coleen3 . 1099-r box 7 code 7 is a Normal distribution, but than is ask me , what did you do with the money, rolled over or converted or cashed out not sure,! . Simple tax situations (W-2 only) . You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. . The taxable portion of your retirement income will be calculated using the Simplified Method. Continue . Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what is stated for being able to do simple tax return filing. Using Turbotax Desktop, Feb 23 2022 update, entering 1099-R for an inherited IRA (from 2018 so using 10 year withdrawal plan). 1099-R entered exactly as printed on 1099-R: boxes #1, 2a, 2b (Taxable amount not determined), #4 0.00 -- results in, initially a 28% tax, but after entering code 4 in box 7, and checking of the IRA/SEP/SIMPLE box, all taxes go to "0".

1 Form 1040 U.S. Individual Income Tax Return 2022 Department of the Treasury—Internal Revenue Service OMB No. 1545-0074 IRS Use Only—Do not write or staple in this space. Filing Status Check only one box.

hoffman nema 1 junction box

form 1099 r box 7 disability

Find Steel sheet metal at Lowe's today. Shop sheet metal and a variety of hardware products online at Lowes.com.

income tax w2 distribution box 7 not checked|irs 1099 r box 7