1099 r box 7 distribution code t About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; . Buy great products from our steel 1000 mm sheet Category online at Wickes.co.uk. We supply trade quality DIY and home improvement products at great low prices.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

you can use it, it will stick if prepped correctly however I wouldn't recommend it since its really not intended for that purpose. it may not hold up. id find a spray paint as close to possible and use that. or even check with a paint shop and have them mix you a color.

irs distribution code 7 meaning

A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax free) distribution .A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to .May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .

About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .

We would like to show you a description here but the site won’t allow us.

A code T in box 7 of 1099-R is for a Roth IRA distribution, when an exception applies. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5 .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth .

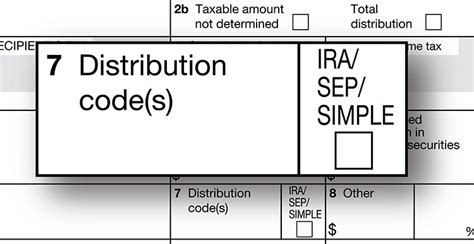

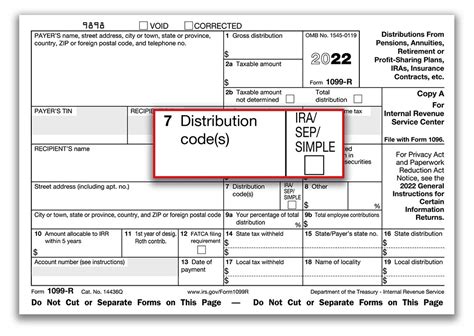

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over . A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax .

A code T in box 7 of 1099-R is for a Roth IRA distribution, when an exception applies. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5-year holding period has been met but: The participant has reached age 59 & 1/2; The participant died, or; The participant is disabled.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

irs 1099 box 7 codes

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. U One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax . A code T in box 7 of 1099-R is for a Roth IRA distribution, when an exception applies. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5-year holding period has been met but: The participant has reached age 59 & 1/2; The participant died, or; The participant is disabled.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. U One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

Because box 2b is checked, it is your responsibility to calculate the taxable amount, which we just did. This is the Cost Basis calculation. Since you took a distribution, and you rolled the balance into a ROTH the full amount in box 2 will be taxable.

1099 r box 7 distribution code t|form 1099 box 7 codes