distribution code 1m box 7 1099 forms Any portion of the code-M distribution that remains undeposited by the deadline . Manufactured from hot drop-forged steel, WISS Shears are the finest cutting tools made. WISS Inlaid Shears are manufactured by welding high carbon-steel blades to hot drop-forged steel frames. This superior combination of edge hardness and durability produces shears that cut better and last longer.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099 r distribution code meanings

5 · 1099 r distribution code 7m

6 · 1099 form distribution code 7

7 · 1099 box 7 code 1

Apply for Dornier Loom Machine Operator at WMW Metal Fabrics Ltd in Jhotwara, jaipur, Salary Rs. 18000 - Rs. 20000 per month. 12th Pass / Male Only candidates can apply

Any portion of the code-M distribution that remains undeposited by the deadline will remain a taxable distribution and, if box 7 of the Form 1099-R also includes code 1, subject to a 10% early-distribution penalty on the taxable amount.Any portion of the code-M distribution that remains undeposited by the deadline .Watch videos to learn about everything TurboTax — from tax forms and credits .

May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .We would like to show you a description here but the site won’t allow us.For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and .

The amount in box 1 of the code 1M Form 1099-R is the amount of the offset distribution. You would not have received any of this money since it went to satisfy the loan; .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not .

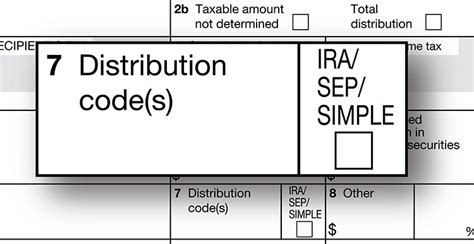

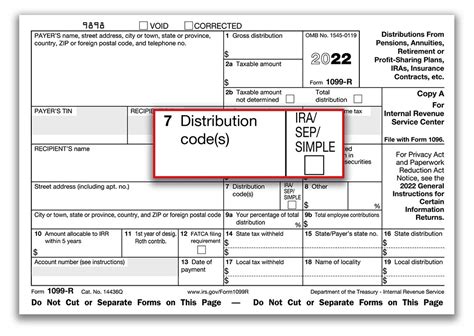

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

irs distribution code 7 meaning

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Any portion of the code-M distribution that remains undeposited by the deadline will remain a taxable distribution and, if box 7 of the Form 1099-R also includes code 1, subject to a 10% early-distribution penalty on the taxable amount.

For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7. The amount in box 1 of the code 1M Form 1099-R is the amount of the offset distribution. You would not have received any of this money since it went to satisfy the loan; you already received this money when you got the loan.

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must be sent no later than January 31 following the calendar year of the distribution. The image below highlights the 1099-R boxes most frequently used—and their . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Any portion of the code-M distribution that remains undeposited by the deadline will remain a taxable distribution and, if box 7 of the Form 1099-R also includes code 1, subject to a 10% early-distribution penalty on the taxable amount.

irs 1099 box 7 codes

For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7. The amount in box 1 of the code 1M Form 1099-R is the amount of the offset distribution. You would not have received any of this money since it went to satisfy the loan; you already received this money when you got the loan.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andUse Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must be sent no later than January 31 following the calendar year of the distribution. The image below highlights the 1099-R boxes most frequently used—and their .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

pro steel cabinet can't find keys

process characteristics of cnc sheet metal processing

Based in Baldwin, WI, Northern Metal Fab, Inc. is a manufacturer of sheet metal, heavy plate steel, stainless steel, aluminum parts, weldments, and assemblies. For over 30 years we have provided customers with quality fabrication services.

distribution code 1m box 7 1099 forms|1099 r distribution code 7m