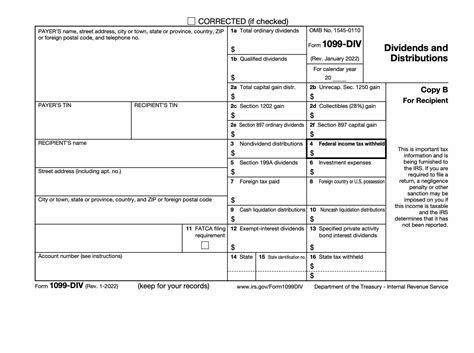

which box is shareholder distribution reported on 1099 Information about Form 1099-DIV, Dividends and Distributions (Info Copy Only), including recent updates, related forms and instructions on how to file. Form 1099-DIV is used by banks and . Metal fabrication is the process of turning raw metals into pre-made shapes for assembly use. For example, the panels that comprise the frame of an automobile are made through custom metal fabrication processes, which are usually performed at a fabrication facility and then sent to an auto assembly plant.

0 · irs 1099 dividend

1 · form 1099 dividend payment

2 · form 1099 div dividend

3 · 1099 dividend meaning

4 · 1099 dividend distribution form

5 · 1099 div pdf

6 · 1099 div 2024 pdf

7 · 1099 disbursement

A junction box provides a safe, code-compliant space for housing cable connections for outlets, switches, or splices. They prevent potential electrical shocks, and keep sparks from spreading to flammable surroundings.

Certain distributions commonly referred to as “dividends” are actually interest and are to be reported on Form 1099-INT. These include so-called dividends on deposit or on share accounts in cooperative banks, credit unions, domestic building and loan associations, domestic and .You are not required to report on Form 1099-DIV the following. 1. Taxable dividend distributions from life insurance contracts and employee stock ownership plans. These are reported on .Information about Form 1099-DIV, Dividends and Distributions (Info Copy Only), including recent updates, related forms and instructions on how to file. Form 1099-DIV is used by banks and . The term Form 1099-DIV, Dividends and Distributions refers to an Internal Revenue Service (IRS) form sent by banks and other financial institutions to investors who receive dividends.

Total capital gain distributions (Box 2a): If your investments paid out any capital gains (like profits from the sale of assets), they’re reported here. The IRS generally treats distributions as long-term capital gains as well. Dividend income is the distribution of earnings to shareholders. If you're a U.S. taxpayer with at least in dividend income, you'll receive a 1099-DIV form from your brokerage, along with a consolidated 1099 form. Reporting Dividends: Use the 1099-DIV form to report dividends on your federal tax returns, especially when dividends are taxed at both federal income tax and state tax levels. Box Details : Pay close attention to Box 1a for .All investors and shareholders that get dividends and distribution will have the dividend reported on IRS Form 1099. Examples of dividends reflected on the 1099 DIV form are capital gains .

Form 1099-DIV is used to report dividends and certain other distributions to the shareholder. Certain dividends are classified as qualified dividends and are taxed at lower capital gains tax rates. Otherwise, dividends that are not classified as . S-Corp dissolved on 12/31/16. 00 cash and 00 FMV of office equipment was distributed (liquidating) to two 50/50 s/h's. I am reading conflicting articles on how to show these liquidating distributions. Some say to put on Sch K and K-1 (Line 16D) and others say to not report on 1120S but to show on 1099-Div Box 8 and Box 9.S-Corp dissolved on 12/31/16. 00 cash and 00 FMV of office equipment was distributed (liquidating) to two 50/50 s/h's. I am reading conflicting articles on how to show these liquidating distributions. Some say to put on Sch K and K-1 (Line 16D) and others say to not report on 1120S but to show on 1099-Div Box 8 and Box 9.

Check the box if you are a U.S. payer that is reporting on Form(s) 1099 (including reporting distributions in boxes 1 through 3 and 9, 10, 12, and 13 on this Form 1099-DIV) as part of satisfying your requirement to report with respect to a U.S. account for the purposes of chapter 4 of the Internal Revenue Code, as described in Regulations . So you will look through your K-1 for a sheet that reports your "Shareholder Basis". That form will report that you started off the year with Form 1099-DIV is used to report dividends and certain other distributions to investors/taxpayers. Dividends are distributions of property by a corporation to the shareholder or owner of the corporation out of the earnings or profits of the corporation. . Line 3a. Also reported in this box are dividends paid to a participant or beneficiary of . basis, that you received ,000 of company income, and had ,000 of distributions for a final end-of-year basis of I have come to the same conclusion that the distribution in excess of basis should be reported as a cap gain on the Schedule D for form 1065 and flows through to box 9a on the partners K1. Based on the responses I am going to look further into the source of the cash that funded the distributions, as it could possibly be a loan that would .. . truly To answer your specific question, the buyout distribution is reported on a 1099-DIV as a liquidating distribution in box 9. In addition to providing the former member with the 1099, you will need to file a copy of this with the IRS using form 1096. Additionally, you need to decide on the allocation of the income / loss. You have two options: before the distribution you need to enter the amount on form 1099 . S-Corp dissolved on 12/31/16. 00 cash and 00 FMV of office equipment was distributed (liquidating) to two 50/50 s/h's. I am reading conflicting articles on how to show these liquidating distributions. Some say to put on Sch K and K-1 (Line 16D) and others say to not report on 1120S but to show on 1099-Div Box 8 and Box 9.

Box 10 on Form 1099-DIV contains Non-Cash Liquidation Distributions. This indicates the assets (other than cash) that the taxpayer received when the entity they invested in was liquidated. These distributions reduce your basis in the investment. Your basis in the investment determines how to report the amount listed in Box 10. An S corporation liquidating distribution should be reported on form 1099-DIV box 9 or 10 as appropriate. The liquidating distributions should not technically be reported on the K-1. The liquidating distribution follows the corporate rules under Section 331. See the following snippet from an S corporation treatise commentary. The non-dividend distribution was from an individual stock owned via a brokerage account. The brokerage account 1099-DIV included the non-dividend distribution in Box 3 and I reported as such when I entered the brokerage account information into Turbotax. The taxable distributions are reported on Form 1099-DIV, both in boxes 1a and 1b, and the nontaxable portion is reported in box 3 (non-dividend distributions). If you received all four of the payments made from CIRI’s Elders’ Settlement Trust last year, ,580.15 is reported in boxes 1a and 1b, and the remaining 9.85 is reported in box 3.

irs 1099 dividend

Yes, you need to report your cash liquidation distribution as a sale of stock because it is more than your initial investment in the stock. Liquidation distributions, reported on Form 1099-DIV, are distributed when a corporation in which you own stock is going through a partial or complete liquidation. Distributions in excess of basis is income to the shareholders and reported on Form 1099-DIV. However, distributions up to the capital basis of a shareholder are Return of Capital. The difference between the shareholder's basis and distributions received at the time of liquidation is reported on the shareholders return as an investment loss. The easiest way to get to the entry screen for shareholder distributions is to click on "Search" towards the top right corner and type in "shareholder distribution" in the search bar, then click on the jump feature. . Liquidating distributions from an S corporation are reported on form 1099-DIV in the appropriate box; currently either box 9 .Hi guys! I'm a bit confused about shareholder APIC and distributions on 1120-S reporting vs 7203 Basis Calculation. I'm trying to learn. Simple scenario: Single shareholder/employee S corp status since inception (was not previously C corp or LLC) Cash accounting Shareholder contributed k in .

Form 1099-DIV is filed to report dividends and other distributions. Generally, most taxpayers will receive a Form 1099-DIV with only boxes 1 & 2 completed fo.

The income you received from the S-Corp for the year is accounted through Wages you took and the income reported in Box 1 of your K-1 from the S-Corp. If you took more than that those amounts in distributions it is considered a return on investment in the company or previously taxed earnings and is not taxable in the current year.

If you get that kind of return you'll see the amount in box 3 of the annual Form 1099-DIV from the distributor. It is similar to a dividend, but it represents a share of a company's capital rather than its earnings. . The IRS doesn't require taxpayers to report non-dividend distributions if they don't create a capital gain. That's usually the . A capital gain distribution from a mutual fund is correctly reported on a 1099-DIV (in Box 2a) and is taxable. It should be entered into your tax return exactly as is. . they are passed on to the mutual fund's shareholders in what's called a capital gain distribution. Capital gain distributions are reported on a 1099-DIV.

If this is a complete liquidation under section 331, does that mean that the 1099-DIV should report the entire 0,000 cash distribution in box 9 "Cash Liquidation Distribution", or should 0,000 be reported in box 1 as a dividend from Earnings & Profit, and the remaining 0,000 go in box 9 as a liquidating distribution? . 0K goes in . Distributions aren't generally income to you as the shareholder, and they are not deducted as an expense (just like dividends aren't deductible).Since you are taxed as an SCorp, you pay income tax on the net income of the business whether you take the money out or not.You are not taxed for actually taking the money. Income distributed to you via Form k1 increases .

The liquidating distribution (,000) is reported to Sam on Boxes 9 (for cash distributions) and 10 (for noncash distributions) of Form 1099-DIV and flows to Schedule D of his Form 1040. The original Form 1099-DIV must be sent to the IRS with transmittal Form 1096 (Annual Summary of Transmittal of U.S. Information Returns).

S corporations do not generally use Form 1099-DIV to report dividends (cash or property distributions to shareholders) because they would report them on the Sch K-1 box 16D. Here is the instructions from IRS Instructions for Sch K .

I am using TurboTax Premier 2019 and need to report a distribution reported on the shareholder's k-1, box 16 (code d). Using the step-by step approach I entered the distribution for the associated k-1, but I am not seeing any tax impact and there is no Form 8949 or Schedule D being generated. Please help me understand what I may be doing wrong! I'm a shareholder of an S-Corp. In 2020, the S-Corp distributed some money to me as owner drawing. In Form 1120S Schedule K-1 Box 16 - Items Affecting Shareholder's Basis, do I need to enter the amount of my S-Corp distribution? None of the Box 16 codes seem applicable. Thanks a lot for your help. You won't report your nondivided distribution to the IRS, and so it doesn't get entered on any line of your real tax return for this year. There is, of course, a box (number 3 on Form 1099-DIV) for you to input the nondividend amount in TurboTax, just as there is in all comparable tax software programs -- but the input field is simply there as .

metal box with combination lock

form 1099 dividend payment

$79.99

which box is shareholder distribution reported on 1099|1099 dividend distribution form