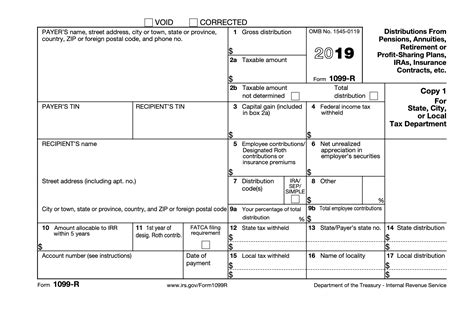

2018 1099-r w box 7g w total distribution x The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if . Discover three stylish ways to hang multiple pendant lights in your space, from junction boxes to track lighting and multi-pendant canopies. Elevate your interior design with impactful lighting solutions.

0 · irs form 1099 r

1 · distribution code g box 7

2 · box 7 r code

3 · box 7 ira contribution codes

4 · 1099r exchange code

5 · 1099 r direct rollover

What is the right pipe for water supply, drainage, and sewer, for both interior and exterior? This guide breaks down common plumbing pipe materials such as PEX, copper, and ABS, to help you choose which is best for your space and application. PEX (cross-linked polyethylene) is a durable plastic piping that's used to supply water.

irs form 1099 r

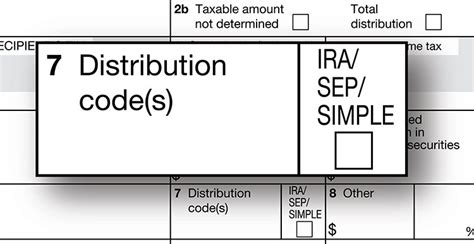

If the first box is checked, the payer was unable to determine the taxable amount, and box 2a should be blank, except for an IRA. It’s your responsibility to determine the taxable amount. If .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA . The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if . What Are Distribution Codes on Form 1099-R? Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the .

Form 1099-R 2018 Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, 2b Taxable amount not Insurance Contracts,etc. determined Total distribution X 3 .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

shrink sheet metal

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. Here’s a . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .Information on distribution codes that are listed in Box 7 of Form 1099-R are available in the IRS Instructions for Forms 1099-R and 5498 OR in the TaxAct® program within the Retirement .We have added two new distribution codes, C and M, for box 7. New rollover code. We have added code "PO" for reporting qualified plan loan offset rollovers. In addition, see the 2018 General Instructions for Certain Information Returns for information on the following topics.

If the first box is checked, the payer was unable to determine the taxable amount, and box 2a should be blank, except for an IRA. It’s your responsibility to determine the taxable amount. If the second box is checked, the distribution was a total distribution that closed out your account. Box 3.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. What Are Distribution Codes on Form 1099-R? Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account.Form 1099-R 2018 Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, 2b Taxable amount not Insurance Contracts,etc. determined Total distribution X 3 Capital gain (included in box 2a) $ 4 Federal income tax withheld $ 120.09 5 Employee contributions / Designated Roth contributions or insurance premiums $Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. Here’s a guide to help you choose the correct code.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Information on distribution codes that are listed in Box 7 of Form 1099-R are available in the IRS Instructions for Forms 1099-R and 5498 OR in the TaxAct® program within the Retirement Plan Income section of the Q&A: From within your TaxAct return (Online or Desktop), click Federal.We have added two new distribution codes, C and M, for box 7. New rollover code. We have added code "PO" for reporting qualified plan loan offset rollovers. In addition, see the 2018 General Instructions for Certain Information Returns for information on the following topics.If the first box is checked, the payer was unable to determine the taxable amount, and box 2a should be blank, except for an IRA. It’s your responsibility to determine the taxable amount. If the second box is checked, the distribution was a total distribution that closed out your account. Box 3.

distribution code g box 7

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

What Are Distribution Codes on Form 1099-R? Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account.Form 1099-R 2018 Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, 2b Taxable amount not Insurance Contracts,etc. determined Total distribution X 3 Capital gain (included in box 2a) $ 4 Federal income tax withheld $ 120.09 5 Employee contributions / Designated Roth contributions or insurance premiums $Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. Here’s a guide to help you choose the correct code.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

box 7 r code

box 7 ira contribution codes

G-code is the language used to control CNC machines. It stands for 'Geometric Code' and consists of a series of commands that tell the machine what actions to perform, such as moving to a specific point, cutting at a particular speed, or .

2018 1099-r w box 7g w total distribution x|box 7 ira contribution codes