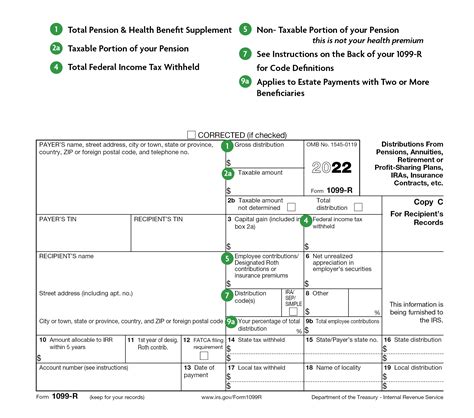

1099 total distribution box Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a . RACO manufactures innovative and high quality steel and nonmetallic electrical boxes, covers, fittings, floor boxes and switches. This historic brand is part of the Commercial Construction .

0 · what is a 1099 r for tax purposes

1 · 1099 taxable amount not determined

2 · 1099 r profit sharing plan

3 · 1099 r gross distribution meaning

4 · 1099 r exemptions list

5 · 1099 r distribution from pension

6 · 1099 r boxes explained

7 · 1099 r 2a taxable amount

Sheet metal welding can be easy if you apply the necessary technique. A welder does not have to have problems with adjusting the welding machine if they apply the necessary methods. Adapt your welding and with time and experience, the results will greatly improve.

Box 9a. Your Percentage of Total Distribution. If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form 1099-R. You need not complete this box for any IRA distributions or for a direct rollover.File Form 1099-R for each person to whom you have made a designated distribution .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. . Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you .

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a .

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the .For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a . The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, .

IRS Forms 1099-R and RRB-1099: essential tax forms used to report distributions from retirement plans, pensions, IRAs, annuities, and railroad retirement benefits, all of which .

Box 2 specifies the taxable amount of the distribution, which is crucial for understanding your tax obligations. The federal income tax that has been withheld from the distribution is noted in.Box 9a. Your Percentage of Total Distribution. If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form 1099-R. You need not complete this box for any IRA distributions or for a direct rollover.File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans. Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax.

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution. 1099-R Box 9b: Total Employee Contributions This box identifies the investment for a 403b or a life annuity in a qualified plan. This shows the amount you have already paid in taxes put into the plan.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions.

The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This .

what is a 1099 r for tax purposes

1099 taxable amount not determined

IRS Forms 1099-R and RRB-1099: essential tax forms used to report distributions from retirement plans, pensions, IRAs, annuities, and railroad retirement benefits, all of which may impact your taxable income. . Total distribution: When this box is checked, Box 1 includes the entire balance of your account that was distributed in one tax year .

Box 2 specifies the taxable amount of the distribution, which is crucial for understanding your tax obligations. The federal income tax that has been withheld from the distribution is noted in.

Box 9a. Your Percentage of Total Distribution. If this is a total distribution and it is made to more than one person, enter the percentage received by the person whose name appears on Form 1099-R. You need not complete this box for any IRA distributions or for a direct rollover.

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax. Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution. 1099-R Box 9b: Total Employee Contributions This box identifies the investment for a 403b or a life annuity in a qualified plan. This shows the amount you have already paid in taxes put into the plan.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

For distributions from a Roth IRA, generally the payer isn’t required to compute the taxable amount. You must compute any taxable amount on Form 8606. An amount shown in box 2a may be taxable earnings on an excess contribution. Loans treated as distributions. The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This .

IRS Forms 1099-R and RRB-1099: essential tax forms used to report distributions from retirement plans, pensions, IRAs, annuities, and railroad retirement benefits, all of which may impact your taxable income. . Total distribution: When this box is checked, Box 1 includes the entire balance of your account that was distributed in one tax year .

1099 r profit sharing plan

1099 r gross distribution meaning

Fabrication is the process of taking raw stock material and creating an end product, which often involves welding. The fabrication process includes steps such as design, forming, cutting, machining, casting, stamping and punching. Since welding is a type of fabrication, it’s not uncommon for welders to know fabrication techniques.

1099 total distribution box|1099 r gross distribution meaning