1099 r box 7 distribution code 2 1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 . Explore our exquisite collection of wholesale gift boxes. Elevate your brand with custom designs and premium packaging solutions. Get a quote today!

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

Buy pill cases & boxes in bulk online from 99 verified wholesale pill cases & boxes suppliers, manufacturers (OEM, ODM & OBM), distributors, and factory lists on Global Sources.

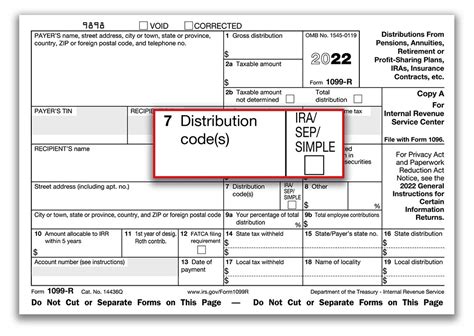

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" . Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" mean in the code explanation? I was 55 when I retired.

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 .

Use Code 2 only if the participant has not reached age 59 1/2 and you know the . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . (as opposed to .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) .

Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" mean in the code explanation? I was 55 when I retired.

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R. Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply.

bendable metal bracket

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Code 2 is in box 7 of my 1099-R. What does "early distribution, exception applies" mean in the code explanation? I was 55 when I retired.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, which is the distribution code(s) box of your Form 1099-R.

what does code 7d mean

Producing custom metal stamping parts created to your specs as well as providing design expertise that helps you get a custom component in the most time- and cost-effective manner.

1099 r box 7 distribution code 2|irs 1099 box 7 codes