1099-r box 7 distribution code 6 If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . A junction box – also known as an ‘electrical box’, ‘jbox’, ‘or ‘terminal box’ – is a protective box where wires are interconnected. Junction boxes are often built into the plaster of a wall, in the ceiling, or within concrete.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

While it may be technically possible to use an outlet as a junction box, it is not a safe or recommended practice. Outlets are not designed to provide the same level of .

sheet metal fabrication madision wi

irs distribution code 7 meaning

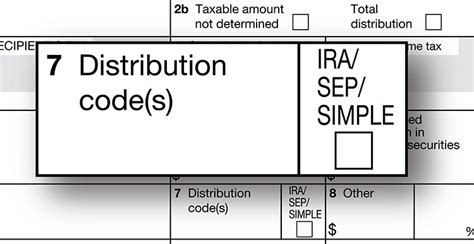

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

irs 1099 box 7 codes

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 .

Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term . One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code . Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial transaction in which a life insurance or annuity policy is replaced for a new one without any taxable event . Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term care insurance, or endowment contracts under section 1035. One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B . Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial transaction in which a life insurance or annuity policy is replaced for a new one without any taxable event (Basically, it just means replacing one annuity contract .

Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term care insurance, or endowment contracts under section 1035. One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

form 1099 box 7 codes

Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial transaction in which a life insurance or annuity policy is replaced for a new one without any taxable event (Basically, it just means replacing one annuity contract .

1099 r minimum reporting amount

sheet metal fabrication lodi ca

sheet metal fabrication introduction

Get festive faster by picking up a stocking, an ornament, a present or more at these Christmas stores across the U.S. bringing tidings of good cheer ahead of and/or after December 25.

1099-r box 7 distribution code 6|1099 r distribution code meanings