cash liquidation distributions box 9 If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then . Xometry is tapping into the power of Deep Learning to efect a step change in how custom manufacturing gets done.Custom online sheet metal fabrication services, prototypes, and formed parts in aluminum, copper, brass, steel, and stainless steel. Instant online fabrication quotes, engineering .

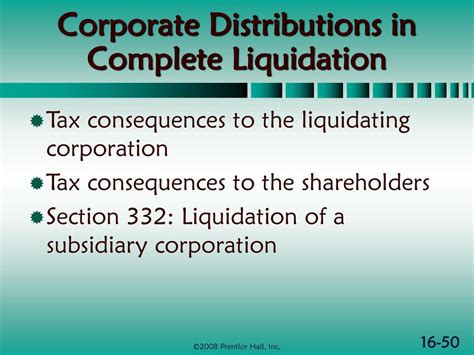

0 · tax consequences of liquidating distributions

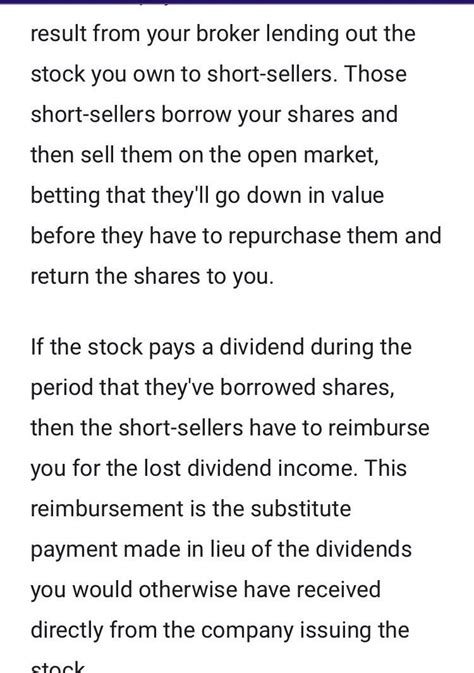

1 · payments in lieu of dividends

2 · liquidating distribution tax treatment

3 · irs qualified dividends worksheet

4 · irs qualified dividend

5 · are liquidating dividends taxable

6 · are cash liquidation distributions taxable

7 · 1099 div nondividend distributions

Gorgeous Fushia Pink Jacquard Fabric, 3D Embossed Rose Brocade, Damask Fabric for Dress, Haute Couture, DIY Fabric 57 inches width . 2.7 yard Vintage Turquoise Seersucker Fabric - Woven Textured Polyester Dress, Clothing, Apparel Material, 56" wide yardage . Elegant Gold Crushed Metallic Wrinkle Textured Christmas Wired Ribbon - 1.5"W x 5 .

If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale.If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then .

Find answers to your questions about view all help with official help articles from .Find TurboTax help articles, Community discussions with other TurboTax users, .Get started: Watch and learn from our expanding video series. Most videos are .

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final .Box 9. Cash Liquidation Distributions. Enter cash distributed as part of a liquidation. You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you . In the Sales price field, enter the amount reported in box 9 or 10 of the 1099-DIV. Enter the known basis amount in the Cost or other basis (do not reduce by depreciation) field. .

I have received at 1099-DIV with the amount of the check I received reported in Box 9, "cash liquidation distributions." I entered the information from this 1099-DIV in TurboTax .Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040).

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in .See what you need to do if you have data to enter in Box 9 from Form 1099-DIV. Also, follow the given steps to report a capital gain or loss on Schedule D.Solved: Box 9 on 1099-Div shows Cash liquidation for AABA. This was a Partial Distribution from AABA - the balance is in escrow to be paid in 2020 or 2021

If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale. If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. .

Box 9. Cash Liquidation Distributions. Enter cash distributed as part of a liquidation. You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. In the Sales price field, enter the amount reported in box 9 or 10 of the 1099-DIV. Enter the known basis amount in the Cost or other basis (do not reduce by depreciation) field. Related topics

tax consequences of liquidating distributions

I have received at 1099-DIV with the amount of the check I received reported in Box 9, "cash liquidation distributions." I entered the information from this 1099-DIV in TurboTax and then received the messages, "We'll handle your cash distribution of .Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040).

metal fabricator apprentice

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.See what you need to do if you have data to enter in Box 9 from Form 1099-DIV. Also, follow the given steps to report a capital gain or loss on Schedule D.

Solved: Box 9 on 1099-Div shows Cash liquidation for AABA. This was a Partial Distribution from AABA - the balance is in escrow to be paid in 2020 or 2021If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale. If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. .Box 9. Cash Liquidation Distributions. Enter cash distributed as part of a liquidation.

You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. In the Sales price field, enter the amount reported in box 9 or 10 of the 1099-DIV. Enter the known basis amount in the Cost or other basis (do not reduce by depreciation) field. Related topics I have received at 1099-DIV with the amount of the check I received reported in Box 9, "cash liquidation distributions." I entered the information from this 1099-DIV in TurboTax and then received the messages, "We'll handle your cash distribution of .Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040).

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.See what you need to do if you have data to enter in Box 9 from Form 1099-DIV. Also, follow the given steps to report a capital gain or loss on Schedule D.

payments in lieu of dividends

liquidating distribution tax treatment

We consider ourselves the innovator of the metal fabric category. Which isn’t just .

cash liquidation distributions box 9|are cash liquidation distributions taxable