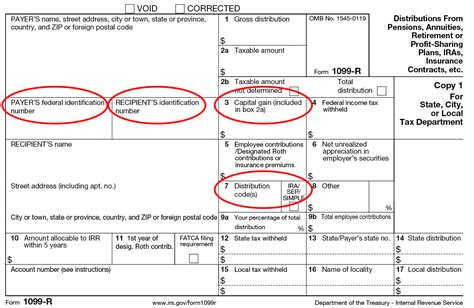

box 7 of 1099 r for roth ira early distribution The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Experience unparalleled carving, cutting, and shaping capabilities in woodworking and more. Elevate your craft with this advanced CNC system. Configure, Design and Cut projects in minutes - all on one, easy-to-use platform.

0 · irs roth distribution instructions

1 · irs form 1099 r distribution

2 · irs 1099 r box 7

3 · form 1099 r box 7 disability

4 · box 7 1099 r meaning

5 · 1099 r ira distribution code

6 · 1099 r box 7 examples

7 · 1099 r box 7 distribution

$24.99

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).File Form 1099-R for each person to whom you have made a designated distribution .

However, you don't have to file Form 5329 if your Form 1099-R, Distributions From .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code J, Early distribution from a Roth IRA, to report a Roth IRA distribution when the IRA owner is under age 59½ and codes Q and T do not apply. But use code 2 for an IRS levy and code 5 for a prohibited transaction.

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Direct rollover of a . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth . For participants born before a certain date, or their beneficiaries to indicate the distribution may be eligible for the 10-year tax option method of computing the tax on lump .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . Use Code J, Early distribution from a Roth IRA, to report a Roth IRA distribution when the IRA owner is under age 59½ and codes Q and T do not apply. But use code 2 for an IRS levy and code 5 for a prohibited transaction.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax. However, you don't have to file Form 5329 if your Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. shows distribution code 1 in Box 7.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Direct rollover of a designated Roth account distribution to a Roth IRA. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

For participants born before a certain date, or their beneficiaries to indicate the distribution may be eligible for the 10-year tax option method of computing the tax on lump-sum distributions (on Form 4972, Tax on Lump-Sum Distributions).

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . Use Code J, Early distribution from a Roth IRA, to report a Roth IRA distribution when the IRA owner is under age 59½ and codes Q and T do not apply. But use code 2 for an IRS levy and code 5 for a prohibited transaction.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.

However, you don't have to file Form 5329 if your Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. shows distribution code 1 in Box 7.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Direct rollover of a designated Roth account distribution to a Roth IRA. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

irs roth distribution instructions

can you place two circuits in same junction box

can you use a plastic junction box

The mbira (or kalimba) is an African musical instrument consisting of a wooden board (often fitted with a resonator) with attached staggered metal tines, played by holding the instrument in the hands and plucking the tines with the thumbs.

box 7 of 1099 r for roth ira early distribution|1099 r box 7 examples